Bank Notes

Transactions involving the exchange of cash (banknotes) between two parties, such as cash withdrawals, deposits, or currency exchange.

- Key Features

- Foreign exchange buy or sell transaction services in the form of banknotes or cash in the following currencies:

-

USD EUR JPY CNY SAR GBP AUD HKD SGD MYR - Value Date: FX Today

- Special Rate: Min. transaction ≥ Rp 25 million

- Transaction Threshold: USD 100,000 without underlying documentation

- Benefits

- Bank Jatim provides trading services for global banknotes such as USD, AUD, GBP, SGD, EUR, JPY, HKD, CNY, MYR, and SAR.

- Customers can transact using special rate facilities if they meet the requirement of a minimum transaction ≥ Rp 25 million / Rp 20 million (for priority customers).

- Foreign exchange transaction services are provided to meet customer needs such as traveling abroad, export-import business needs, investment instruments, foreign currency savings, and Hajj/Umrah payments.

- Requirements

- Treasury Bank Notes transactions are conducted in foreign currency denominations, both in the wholesale market (interbank) and retail with commercial customers (Individuals and Non-Individuals) who have Transaction Facilities.

- Treasury Bank Notes transactions are conducted through Foreign Exchange Business Activities (KUPVA) or Money Changers.

- Attach a photocopy of a valid identity document (Indonesian Citizen: KTP; Foreign National: Passport) for both Walk-In Customers (WIC) and existing customers.

- Customers are required to fill out the Bank Notes Buy/Sell Transaction Form.

- Customers must sign an authenticated written statement for the purchase of foreign currency against the Rupiah.

- Customers must comply with the provisions required by the regulator (Bank Indonesia).

- RIPLAY (Product and Service Information Summary)

- RIPLAY (Product and Service Information Summary) General Version is a standard document containing comprehensive important information regarding financial products or services.

- RIPLAY Bank Notes

- Promo BUY SAR GET GOLD 2026

- Product Name: Bank Notes (PROMO BUY SAR GET GOLD 2026)

- Product Description: Transactions involving the exchange of cash (banknotes) between two parties, such as cash withdrawals, deposits, or currency exchange.

- Segmentation: Individual and Corporate Customers

- Key Product Features

- Currency: SAR

- Value Date: FX Today

- Special Rate: Min. transaction ≥ Rp 25 million

- Transaction Threshold: USD 100,000 without underlying documentation

- Fees

- Medium Banknote Fee: *subject to applicable terms and conditions

- Banknote Withdrawal Fee: 0.5% of the Monthly Withdrawal Limit

- Banknote Deposit Fee: 0.5% for Banknotes in Medium condition

- Benefits

- Bank Jatim provides trading services for SAR banknotes.

- Customers can transact using special rate facilities if they meet the requirement of a minimum transaction ≥ Rp 25 million / Rp 20 million (for priority customers).

- Foreign exchange transaction services are provided to meet customer needs such as Hajj/Umrah payments and living costs.

- Risks

- Risk of foreign exchange price movements in the market.

- Failure of transaction settlement if there are errors in the instructions provided by the customer or bank officers.

- Terms and Conditions

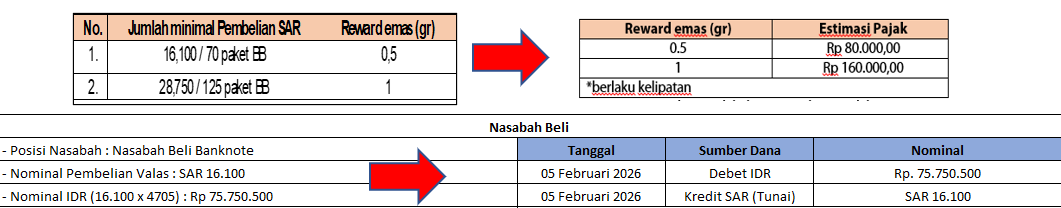

- The SAR Gold 2026 Promo is a promotion related to SAR banknote sales transactions, where customers receive a reward in the form of gold for specific purchase amounts.

- Rewards will be given to customers who purchase SAR banknotes using the Counter Rate for Package B and special rates for other denominations (subject to confirmation by the Treasury Division).

- Tax on prizes is borne by the customer receiving the reward.

- Treasury Bank Notes transactions are conducted through Foreign Exchange Business Activities (KUPVA) or Money Changers.

- Attach a photocopy of a valid identity document (Indonesian Citizen: KTP; Foreign National: Passport) for both Walk-In Customers (WIC) and existing customers.

- Customers are required to fill out the Bank Notes Buy/Sell Transaction Form.

- Customers must comply with the provisions required by the regulator (Bank Indonesia).

- Simulation

- Additional Information

- Head Office officers will perform a debit transaction for the total prize tax amount from each branch on the first working day of the following week.

- Any excess in the tax amount deposited by the customer over the tax amount debited by the Head Office will be returned to the customer after the gold reward is issued.

- If the amount of Foreign Currency purchase against Rupiah exceeds USD 100,000 (or its equivalent), it must be accompanied by a stamped statement letter, underlying documents, a photocopy of valid identity, and a photocopy of the NPWP (Tax ID).

- The bank is obliged to inform customers of any changes to benefits, fees, risks, terms, and conditions of the product or service through letters or other methods in accordance with applicable terms and conditions.

- Disclaimer

- The customer has read, received an explanation of, and understood the product according to the Product and Service Information Summary.

- This Product and Service Information Summary is not part of the foreign exchange transaction application.

- The customer is required to read and understand the Product and Service Information before agreeing to the foreign exchange transaction rate.

- The information covered in this Product and Service Information Summary is valid until the latest update of the Summary regarding foreign exchange transactions.

- The bank may reject the customer's application if it does not meet the requirements and applicable regulations.

- The customer must carefully read this Summary and contact the bank for further questions regarding the products and/or services contained in this Summary.

- Enjoy Various JConnect Mobile Features

- Download the JConnect Mobile application on Google Play and App Store

- Social Media

- Further Information

- Bank Jatim Info Call Center 14044

- WhatsApp PRITA

- Bank Jatim is licensed and supervised by the Financial Services Authority (OJK) & Bank Indonesia. Bank Jatim is a member of the Deposit Insurance Corporation (LPS).

For further terms/details regarding our products, please contact Bank Jatim Info at 14044 or visit a Bank Jatim Branch Office directly.