Close 2014 With Prides Achievement, Bank Jatim Predicted Increasingly Shiny In 2015

Date: 10 march 2015Categories :

Bankjatim Management is optimistic that the good performance throughout 2014 ago will continue in 2015. This is confirmed by looking at the economic growth opportunities in East Java the last few years able to be above the national economic growth (East Java economic growth period in December 2014 amounted to 5.90%, again able to be above the national economic growth of 5.00%).

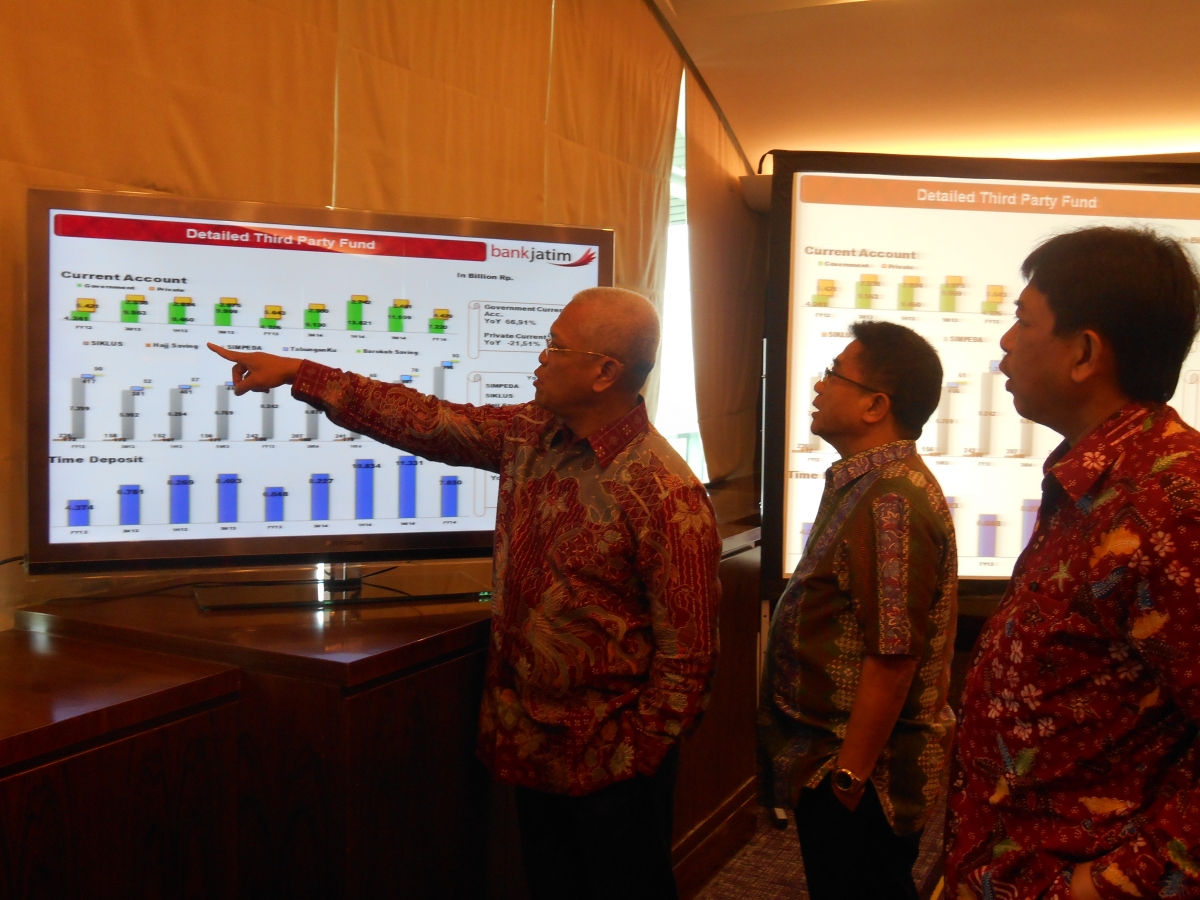

Based on data from Bank Indonesia and Finance Economic Studies Regional East Java province in 2013 and 2014 period, bankjatim able to achieve above-average growth of the National Bank in Indonesia and Banks in East Java, either of the category's total assets, Third Party Funds (Giro, Savings, Deposits) and Loan (Productive and Consumptive).

From a total of 119 banks in Indonesia, bankjatim ranks 25th in total assets and total loans, ranked 21th for total Third Party Funds, ranked 8th for paid-in capital and ranked 16th for pre-tax profit (BI, December 2014 unaudited) .

Based on the financial statements of December 2014 (audited), bankjatim recorded a pre-tax profit of Rp 1.37 trillion, an increase of 19.27% compared with the period December 2013 (YoY). Besides other bankjatim financial performance also showed growth, among others, total assets amounted to Rp37,99 trillion, up 14.98% (YoY), Third Party Funds for Rp30,27 trillion, up 16.48% (YoY), loan portfolio amounted to Rp26,19 trillion, up 18.61% (YoY), and net profit amounted to Rp939,08 billion or increased 13.92% (YoY).

Contributions Giro in the composition of the Third Party Funds contributed the highest number that is equal to Rp11,65 trillion, up 16.86% (YoY), Savings followed by Rp10,99 trillion, up 10.23% (YoY), and deposits of Rp7,63 trillion, up 26.16% (YoY). With such composition, CASA ratio bankjatim maintained in position in December 2014 amounted to 74.80%.

The largest contribution loan composition obtained from consumer loans amounting Rp16,71 trillion, up 19.14% (YoY), followed by commercial loans amounting to Rp 5.18 trillion, an increase of 22.53% and SME loans amounting to Rp 4.30 trillion, up 12.38 % (YoY). Of the composition, the largest growth in consumer loans exist on Housing Loan with a total of 1.3 trillion, up 26.71% (YoY), and Multipurpose Credit Rp 14.85 trillion, an increase of 19.20% (YoY). While in commercial loans, syndicated Loan growth dominates the total loans of 1.17 trillion, an increase of 44.59% (YaY). As for the SME Loan, the largest growth achieved by Loan Pundi Kencana Rp 796 billion, or an increase of 55.22% (YoY).

bankjatim performance reflected in the financial ratios such as, CAR of 22.17%, ROA of 3.52%, ROE of 18.98%, NIM of 6.90%, ROA of 69.63%.

Besides financial performance and a very good ratio, loans quality improvement or decline in NPLs from 3.44% to 3.31% is an effort bankjatim in 2014 by billing strategies and coordination mechanisms related to insurance claims.

Currently bankjatim is preparing to launch a new product. Among them, mobile banking, priority banking, mutual funds, Electronic Data Capture, bancassurance, virtual accounts, e-money, visa network, and further development of the products of individual internet banking, e-tax local tax, host to host, as well as the migration card chip.

"In 2015, bankjatim continue to focus on improving technology-based products and services such as internet banking, mobile banking, priority banking and others through a variety of considerations to progress bankjatim among others intended as an alternative delivery channel in addition to the teller, ATM, and SMS Banking. All plans development and publishing products and services currently under preparation and will be subject to approval from the Financial services Authority prior to launch, "said Hadi Sukrianto, President Director bankjatim.

Besides that bankjatim also be more productive sector lending to businesses other economic, one of them with the expansion in the micro sector, which in 2014 ago was able to contribute to the outstanding credit of Rp264,08 billion and the NPL ratio of 0.00%. With the development of this good enough, bankjatim will add 56 new micro units.

The incessant efforts made are expected to achieve the business plan bankjatim in 2015, the total assets grew by 16.38%, Loan rise 20.00%, Third Party Fund rise 17.13%, and Net profit reached 18.80%. As for the expected financial ratios ROA 3.43%, ROE 19.33%, NIM 7.22%, and BOPO 69.70%. (pr/med)